Paying out-of-pocket for health care in Korea: Changes in catastrophic and poverty impact over a decade of 1996-2005

Abstract

Despite the existence of a national health insurance system, out-of-pocket (OOP) payments have been playing an important role in the financing of health care in Korea. Using the data from a nationally representative household expenditure survey, this study aims to examine the trend in the catastrophic and impoverishing impact of OOP payments in Korea over the decade from 1996 to 2005. It also investigates the catastrophic impact by income quintiles and by type of service.

The catastrophic payment headcount is measured as the percentage of households spending OOP payments in excess of 10% of total household expenditures. The poverty headcount is measured by comparing the proportion of individuals who fall below the poverty line before and after OOP payments are deducted from household resources. The national poverty line is used as a poverty threshold.

The percentage of households with OOP payments in excess of the 10% threshold was 11.8% in 1996, went down to 10.2% in 2001, and increased again to 11.8% in 2005. The catastrophic impact has been greatest and has increased among the poorest 20% of households since 2001. The poor are more likely to incur catastrophic payments on drug and outpatient care while the better-off are more likely to spend in excess of the thresholds on inpatient and dental care. The impoverishing effect of OOP payments, though moderate, has been enlarged gradually in recent years.

It is necessary not only to reduce overall OOP payments by extending insurance coverage particularly for inpatient care, but also to ease the vulnerable households’ financial burden by exempting them from some OOP payments.

Keywords:

National health insurance, out-of-pocket payments, catastrophic impact, poverty impactIntroduction

It has been almost 40 years since social health insurance was initiated in Korea in 1977. The most noticeable achievement in the history of the social health insurance was the establishment of the national health insurance (NHI) system in 1989, which achieved universal coverage of the population in only 12 years after the initiation of the social health insurance. Another remarkable change was a full integration of insurance funds in 2000, which merged a total of 375 insurance funds and brought a single-payer insurance system into Korea. After recovering from a financial crisis that the newborn single-payer was destined to face, an insurer named National Health Insurance Corporation has made the extension of insurance coverage a priority among various health policy agendas.

In fact, the NHI has never been comprehensive in terms of insurance coverage despite its universality in terms of population coverage. Most outpatient services and high-probability inpatient services are covered, but many low-probability, high-cost services are excluded. High co-payments are also imposed on covered services. As a result, the insurer pays only about 70% of the expenditures on those services and items covered under the NHI, and patients have to pay out-of-pocket for the remaining 30% and for the expenditures on the services not covered under the NHI as well.

Out-of-pocket (OOP) payments as a way of financing health care have consequences for the utilization of health care and subsequently for health [1-6]. If the share of OOP payments among health expenditures is too large, patients are forced to face a financial barrier to the utilization of health care. In the case of catastrophic illness, for example, some households would face a difficult choice between diverting a large fraction of household resources to cover the costs of treatment and forgoing treatment at the expense of health.

Moreover, the large proportion of OOP payments has differential consequences among households with varying incomes. A well-off household can perhaps finance medical expenses from savings. A less well-off household may be forced to cut back on necessities and consequently pushed into – or further into – poverty [7].

Several studies give evidence on the catastrophic and poverty impact of OOP payments derived from nationally representative expenditure data [8-12]. Two of those studies compared the catastrophic and poverty impact of OOP payments among Asian countries, respectively. One of the two studies included evidence on catastrophic payments in Korea based on the estimate of only one year and did not show the catastrophic impact of OOP payments during a longer period [12]. The other study on poverty impact did not even include Korea because of the incomparability of its poverty level with that of other Asian countries [11].

It would be interesting to look at changes in the catastrophic and poverty impact of OOP payments over a longer period. This is particularly the case with Korea whose health care financing has relied heavily on OOP payments in spite of universal health insurance and which experienced an important change in the financing of health care in 2000. A separation policy, as described in the next section, lowered the proportion of OOP payments in the financing of health care. However, a closer look at its effect on OOP payments reveals that the benefits from lowering OOP payments were not equally distributed among different income groups and that the extent to which OOP payments were reduced differed by different type of health care such as outpatient and inpatient care. This, in turn, leads to a conjecture that there might be variations in the catastrophic impact of OOP payments among varying income groups and/or by different type of health care. A longitudinal analysis of those variations in the catastrophic and poverty impact of OOP payments would help better understand which segment of the population suffers most from large OOP payments. Using the data from a nationally representative household expenditure survey, this study aims to examine the trend in the catastrophic and impoverishing impact of OOP payments in Korea over the decade from 1996 to 2005. It also aims to investigate catastrophic impact by income quintiles and by type of service.

Trend in health care financing in Korea

It is true that the NHI has contributed to reducing a financial barrier to the utilization of health services in Korea over the decade from 1996 to 2005. However, the share of health care funding through the NHI was lower than that of OOP payments until 2000 when the separation policy (SP) was implemented (Table 1).

Before July 2000, physicians were allowed to both prescribe and dispense drugs, and pharmacists to dispense drugs without prescriptions from doctors. The expenditures on drugs dispensed directly by pharmacists were mostly paid OOP. Under the SP, physicians prescribe but do not dispense drugs at their practices, and pharmacists dispense drugs only with prescriptions from doctors. Thus, the NHI has taken over the expenditures on drugs otherwise previously paid OOP. That is probably the main reason that the share of the NHI funding started to exceed that of OOP payments from 2001. Table 1 shows that the share of the NHI funding increased by about 5 percentage points in 2001 while that of OOP payments decreased by a similar amount.

A more careful examination on the effect of the SP on OOP payments shows that its effect varies at two different levels. First and at the system level, the SP led to the reduction of the share of OOP payments in the financing of health care for the above-mentioned reason. Second and at the patient level, however, the SP resulted in the increase in OOP payments that individual patients bore at the time of utilizing health services. This can be explained by the increase in both price and quantity of health services utilized. As an incentive for doctors to accept the SP, the government endorsed an over 30% increase in medical fees within one year in 2000. In addition, with the SP implemented, almost all patients utilizing outpatient care had to visit pharmacies with doctor’s prescriptions, which led to an abrupt increase in patients’ OOP payments.

On the other hand, the NHI had to experience a financial turmoil after the SP was implemented. For the same reason that the absolute amount of patients’ OOP payments increased, the insurer’s expenditures on health care went up rapidly. Facing with a large-scale deficit, the NHI chose to implement every single policy option to contain health expenditures as much as possible. For example, the government increased co-payments for outpatient visit to clinics as well as for drugs in 2001. This, in turn, led to additional increase in the OOP payments of households.

In Korea, poor households tend to spend a disproportionately large share of their resources on outpatient care and drugs, compared to their rich counterparts [13]. Thus, a substantive increase in OOP payments of households, resulting from the SP and the subsequent policy on co-payments, was likely to end up with the increase in castastrophic and poverty impact of OOP payments, in particular, on poor households.

After recovering from the deficit, the government tried to extend overall insurance coverage, but did not reverse the policy on co-payments for outpatient care and drugs which was implemented at the time of financial crisis. Instead, the government chose to lower co-payments for specific diseases such as cancers, mental and rare diseases. Table 2 shows that the insurer’s efforts on coverage extension varied from including new technologies like CT, MRI, and PET under the umbrella of the NHI to directly lowering the patients’ co-payments for specific diseases at the time of utilizing health services [14]. It is noticeable that these efforts were made more frequently after 2004 when the NHI escaped its accumulated financial deficit. The benefits from extending insurance coverage were expected to be provided to all members of society regardless of their economic status, and extra attention was not paid to those most in financial need.

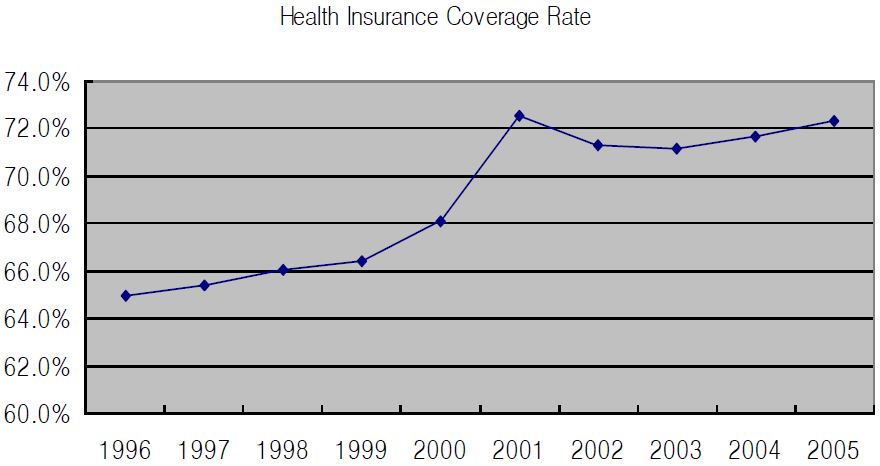

Of the health expenditure for those services and items covered by the NHI, only 65% was paid by the insurer in 1996; the remaining 35% was paid OOP by patients at the time of utilization (Figure 1). Since then, health insurance coverage rate, defined as the proportion of health expenditures paid by the insurer out of total health expenditures for those services and items covered under the NHI, has increased to reach a peak of 72.5% in 2001, and has hung back afterwards, mainly due to the increase in the patients’ co-payments. Overall, health insurance coverage rates display an upward trend over the years, except for the peak in 2001.

Methods

The methodology used to measure the catastrophic and poverty impact of OOP payments is heavily based on that used in the EQUITAP study [11, 12], which in turn draws on a seminal paper [9]. Thus, the explanation of the methodology here is maintained to a minimum.

Measuring the catastrophic effects of OOP payments

Catastrophic payments are defined as OOP payments exceeding some threshold shares of household resources. Although the choice of the threshold share is subjective, 10% of total expenditure is used as a threshold in this study as in some previous studies [8, 9, 15]. The rationale is that at this threshold, households are forced to sacrifice other basic needs, sell productive assets, incur debt, or be impoverished [16].

The catastrophic payment headcount (HC) represents the percentage of households incurring catastrophic payments and its measurement is described elsewhere [9, 12]. The concentration index (CE) represents the correlation of catastrophic payments with household rank in the distribution of living standards. If households exceeding the threshold tend to be worse-off, CE will be negative, and vice versa.

Measuring the impoverishing effects of OOP payments

High OOP payments can expose households to substantial financial risk, sometimes resulting in impoverishment. The impoverishing effect of OOP payments can be measured using the poverty headcount, which denotes the proportion of individuals who fall below a poverty line.

According to the recommendation that poverty be assessed after deduction of health care payments since most of these payments cover essential needs [17], estimates of the poverty headcount are produced and compared before and after OOP payments for health care are deducted from household resources. In terms of a poverty threshold, two kinds of poverty lines are involved: pre-payment and post-payment poverty line. It is argued that the pre-payment poverty line should include an element for health spending while the post-payment poverty line should not, and that it is necessary to deduct an amount from the poverty line corresponding to health spending to arrive at the post-payment poverty line [9]. As the prepayment poverty threshold, the national poverty line (NPL) that the government announces every year is used in this study. To establish the postpayment poverty threshold, the average share of OOP payments among the third income quintile is subtracted from the NPL of each year.

How to estimate the poverty headcount before and after OOP payments for health care are deducted from household resources is described elsewhere [9]. The measures of the poverty impact of OOP payments are then simply defined as the difference between pre-payment and post-payment headcounts.

Data

To examine the trend in catastrophic and impoverishing impact of OOP payments in Korea over the decade between 1996 and 2005, the data from a nationally representative household expenditure survey was used. The household expenditure survey, administer by the National Statistical Office, is carried out nationwide every year for the purpose of helping the government with policy-making by providing basic information on household expenditures. The survey uses cluster sampling, and sampling weights were applied in the analysis to control for it. The average sample size was about 5,200 households during the period between 1996 and 2002, and increased to about 7,400 households during the period between 2003 and 2005. The response rate was, on average, around 80% each year. The survey uses one month recall period, and total expenditure for one month is reported and computed. Like in the EQUITAP study, OOP payments are defined here to include fees, copayments, user charges for public care and purchases of medicines, appliances, diagnostic tests, and so on. Expenditures on Western and traditional care are included. The survey questions on OOP payments were consistent over the period of the study. Analyses were performed with STATA version 9.0.

Results

The catastrophic impact of OOP payments

Table 3 provides the catastrophic payment headcount (HC) and concentration index (CE) over the decade of 1996-2005. The incidence of range of catastrophic payments over the decade amounts to a 10.2-11.8% of households at the threshold of 10% of total expenditures. The percentage of households with OOP payments in excess of this threshold was 11.8% in 1996, went down to 10.2% in 2001, and increased again to 11.8% in 2005. This statistically significant (p<0.05) U-shaped incidence of catastrophic payments implies that OOP payments have increased rapidly relative to household budgets in recent years.

A negative concentration index means that the incidence of catastrophic payments decreases with household living standards. That is, the poorer households are more likely to spend large fractions of their total expenditures on health care. Over the decade, in particular since 2001, the strength of the negative correlation has increased, meaning that more of the poor households have experienced catastrophic payments.

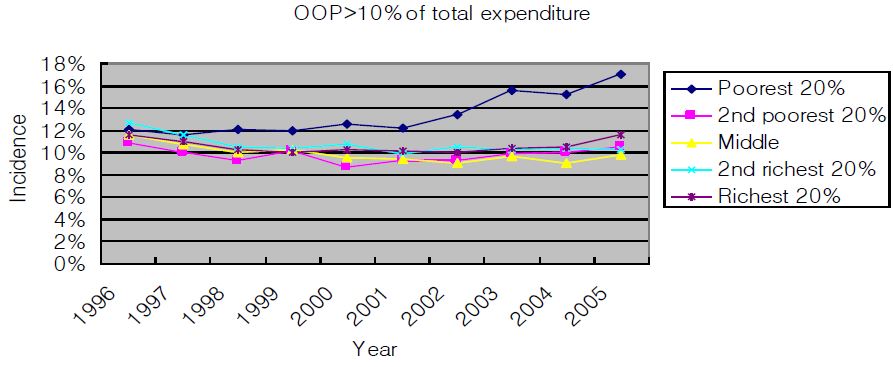

Incidence of catastrophic payments by income quintile is depicted in Figure 2. At the threshold of 10% of total expenditures, incidence of catastrophic payments was similar among income quintile groups in 1996. While it did not change over time among the other quintiles, the incidence increased, particularly after 2001, among the poorest 20% group and the gap continued to be widened. It is evident that, although the NHI has tried to extend insurance coverage, the catastrophic impact of OOP payments for health care has been greatest among the poorest members of Korean society since 2001.

Incidence and intensity of catastrophic payments, segregated by type of service, are provided in Table 4. In 2005, the percentages of households spending in excess of 10% of total expenditures on outpatient care, inpatient care, drug and dental care are 2.5%, 1.5%, 3.0% and 1.6%, respectively. Compared to the catastrophic impact of total OOP payments, concentration indices of incidence of catastrophic payments of disaggregated OOP payments display a much clearer distinction between types of service, and the correlation of catastrophic payments with household rank in the distribution of living standards is much stronger. For example, at the defined threshold of household expenditures, the poor are more likely to incur catastrophic payments on drug and outpatient care while the better-off are more likely to spend in excess of the threshold on inpatient and dental care. This means that the poor may face a financial barrier to the utilization of inpatient and dental care, of which the insurance coverage is partial or very limited, so that they may be forced to substitute medication or outpatient care for inpatient care.

Table 5 shows the average OOP payments, by income quintile, of those households that experienced catastrophic payment and their breakdown by type of service. The average amount of OOP payments among those households experiencing catastrophic payment differs significantly by income quintile (p<0.005). Out of the small amount of OOP payments, the poorest 20% households experiencing catastrophic payment spend a disproportionately large share on drug and outpatient care while, out of the large amount of OOP payments, the richest 20% households experiencing catastrophic payment spend a relatively even share on each service (p<0.005).

The poverty impact of OOP payments

The poverty headcounts based on household expenditures relative to the NPL are shown in Table 6. The poverty headcounts, estimated before subtracting OOP payments from household expenditures, varied from 7.4% in 2004 to 16.8% in 1998. The highest poverty estimate in 1998, followed by that in 1999, has to do with an economic crisis in Korea that occurred at the end of 1997. As a consequence of the economic crisis, household expenditures shrank, and the number of households whose expenditures fell below the NPL increased steeply.

Subtraction of OOP payments from household expenditures did not change the general pattern of poverty headcounts by a great deal, and increased the poverty headcounts by less than one percentage point each year. However, the differences between pre-payment and post-payment headcount were statistically significant (p<0.05). In 2005, for example, the poverty headcount after subtracting OOP payments from household expenditures increased by 0.6 percentage points, equivalent to 292,550 people. Relative to the initial poverty headcount, adjustment for OOP payments increased the poverty estimate by 6.9% in 2005. Although the impoverishing effect of OOP payments appears to be moderate in Korea, there is a concern that, considering the number of individuals impoverished or the relative change in the poverty estimate, the impoverishing effect of OOP payments gradually tends to have become larger in recent years (p<0.01).

Discussion

Using the data from the nationally representative household expenditure survey, the trend in the catastrophic and impoverishing impact of OOP payments in Korea was examined during the period from 1996 to 2005. The main findings from the threshold analyses need further discussion.

First, although the proportion of health care financing through the NHI has increased since 2001, the proportion of households spending in excess of the thresholds has not declined. Rather, the incidence of catastrophic payments produced the upward part of a U-shaped curve. The increasing trend of catastrophic payments can be explained by the fact that OOP payments for health care increase faster than total household expenditures. During the period of 1996-2001, household expenditures increased annually by 4.7% while OOP payments increased annually by 2.5%. After 2001, in contrast, the annual increase rate of OOP payments jumped up to 8.4% while that of household expenditures remained at 4.2%, similar to previous years.

As mentioned above, the steep increase in OOP payments is attributable to the increase in both price and quantity of health services utilized after the implementation of the SP, as well as additional increase in co-payments for outpatient care and drugs. Despite the efforts to increase the overall insurance coverage rate, therefore, households’ OOP payments went up from 2001, leading to a higher incidence of catastrophic payments and increased impoverishment as well.

Second, catastrophic payments occurred among the poor households more frequently compared to the better-off, and the negative concentration indices have been enlarged since 2001, which means more of the poor households have experienced catastrophic payments. The increasing and higher incidence of catastrophic payments among the poor households can be attributed to their limited household resources to cope with increased OOP payments for health care. As mentioned above, the annual increase rate of OOP payments more than tripled after 2001, compared to the period of 1996-2001. The increased OOP payments did not seem to affect consumption in the other income groups except the poorest 20%, so that the incidence of catastrophic payments among each of these groups did not display great variations over the years. In contrast, the increased OOP payments disrupted severely the consumption of the poorest 20% group. Given that their household resources were limited, those with increased OOP payments ended up with reduced spending on other necessities rather than increasing overall household expenditures. Consequently, the incidence of catastrophic payments among the poorest 20% has been increasing since 2001 (Figure 2). It is also noteworthy that the poor households are vulnerable to catastrophic payments even when they spend disproportionately large resources on drug and outpatient care, not on inpatient care.

Third, the incidence of catastrophic payments by type of service shows that the proportion of households spending in excess of the 10% threshold is higher for drug and outpatient care than for inpatient care. This may have to do with the demand for those services. By nature, health problems requiring outpatient care are more common compared to health problems requiring hospitalization. In the Korean context, however, the higher incidence of catastrophic payments in drug and outpatient care than in inpatient care has more to do with insurance coverage. Under the NHI, patients pay more for inpatient care than for outpatient care mainly because of many noncovered inpatient services. Thus, it is likely that patients substitute outpatient care and/or drugs for inpatient care, in particular, when they have limited resources.

In fact, it is observed that the poorest 20% of Korean households spend a disproportionately large share of their resources on drug and outpatient care while the richest 20% spend an approximately equal share on different type of services. For example, among the poorest 20% of households, the budget share of OOP payments on drug is almost ten times as large as that on inpatient care. As shown in Table 5, therefore, the poor households are more likely to experience catastrophic payments in drug and outpatient care while the better-off are in inpatient care. It is not easy to see with the data provided if the higher utilization of drug and outpatient care among the poor households helped them to meet their medical needs appropriately. However, a result from Korea National Health and Nutrition Examination Survey (KNHANES III) shows that the overall health status of the poor members of Korean society is worse than that of their non-poor counterparts [18]. Considering the higher medical needs of the poor, there seems to be inequity in access to health services under the Korean NHI.

Fourth, just like the catastrophic impact, the poverty impact of OOP payments has been increasing in recent years. Further analysis shows that the average budget share of OOP payments among those households impoverished newly because of large OOP payments continued to increase in recent years, amounting to 33.9% in 2005, which was almost 9 times higher than that of those households that remained non-impoverished. In other words, spending about a third of household resources on OOP payments for health care ended up with 1.1% of the population, equivalent to 522,890 individuals, being newly impoverished in 2005.

On the other hand, the poverty impact was greatest among those households with household resources between 100% and 120% of the NPL. Adjusting for OOP payments increased the poverty estimate by 10.6 percentage points among those income groups. In contrast, among the households with household resources between 120% and 200% of the NPL, and over 200% of the NPL, the poverty headcount after adjusting for OOP payments increased by one percentage point and 0.3 percentage points, respectively. Therefore, it is evident that those households below 120% of the NPL are most vulnerable to OOP payments, and it is worthwhile to consider alleviating their financial burden at the time of utilizing health services in order to reduce the impoverishing effect of OOP payments.

This study has several limitations. First, though it estimated catastrophic impact of OOP payments over 10 years, this study did not follow up each of those households that experienced catastrophic payments, and thus could not tell how long the catastrophic impact would last and how severe it would be. This has to do with the nature of the national household expenditure survey, which does not necessarily survey the same households each year. Second, this study identified only the households that incurred catastrophic payments and did not count those that forwent treatment due to lack of household resources. Taking account of unreported forgone treatment, large OOP payments would have a more detrimental effect on the welfare of patients. However, this study was at least successful in showing that the poor tend to seek relatively inexpensive services - drug and outpatient care - to meet their medical needs, irrespective of their medical appropriateness.

Conclusion

It was only a few years ago that the NHI was standing at the crossroads. In the light of its limited role of paying for health care, its proponents claimed that the NHI should extend its insurance coverage in order to cover up to 70% of total health expenditures while others were looking for a gateway for relying further on private health insurance. At the crossroads, Korea has chosen a path for extending the insurance coverage of the NHI in order to relieve patients of the financial burden incurred by high OOP payments.

The findings of this study suggest that the NHI should pay attention to the increasing trend of the catastrophic and impoverishing impact of OOP payments since 2001, and in particular to the higher incidence of catastrophic payments among the poor, and to the financial barrier to the utilization of inpatient care. In conclusion, in order that the NHI may remain as a major way of financing health care in Korea, it is necessary not only to reduce overall OOP payments by extending insurance coverage particularly for inpatient care, but also to ease the vulnerable households’ financial burden by exempting them from some OOP payments.

References

-

Newhouse, J.P., Manning, W.G., Morris, C.N., Orr, L.L., Duan, N., Keeler, E.B., et al. , (1981), Some interim results from a controlled trial of cost sharing in health insurance, New England Journal of Medicine, 305(25), p1501-1507.

[https://doi.org/10.1056/nejm198112173052504]

-

Leibowitz, A., Manning, W.G., & Newhouse, J.P., (1985), The demand for prescription drugs as a function of cost-sharing, Social Science & Medicine, 21(10), p1063-1069.

[https://doi.org/10.1016/0277-9536(85)90161-3]

- O’Brien, B., (1989), The effect of patient charges on the utilisation of prescription medicines, Journal of Health Economics, 8(1), p109-132.

-

Ryan, M., & Birch, S., (1991), Charging for health care: evidence on the utilisation of NHS prescribed drugs, Social Science & Medicine, 33(6), p681-687.

[https://doi.org/10.1016/0277-9536(91)90022-5]

- Brook, R.H., Ware, J.E. Jr., Rogers, W.H., Keeler, E.B., Davies, A.R., Donald, C.A., et al. , (1983), Does free care improve adults’ health? Results from a randomized controlled trial, New England Journal of Medicine, 309(23), p1426-1434.

- Keeler, E.B, Brook, R.H., Goldberg, G.A., Kamberg, C.J., & Newhouse, J.P., (1985), How free care reduced hypertension in the health insurance experiment, Journal of American Medical Association, 254(14), p1926-1931.

- Van Doorslaer, E., O’Donnell, O., Rannan-Eliya, R., Somanathan, A., Adhikari, S.R., Akkazieva, B., et al. , (2005), Paying out-ofpocket for health care in Asia: Catastrophic and poverty impact, EQUITAP Project Working Paper # 2.

-

Pradhan, M., & Prescott, N., (2002), Social risk management options for medical care in Indonesia, Health Economics, 11(5), p431-446.

[https://doi.org/10.1002/hec.689]

- Wagstaff, A., & Van Doorslaer, E., (2003), Catastrophe and impoverishment in paying for health care: with application to Vietnam 1993-98, Health Economics, 12(11), p921-934.

-

Xu, K., Evans, D.B., Kawabata, K., Zeramdini, R., Klavus, Jan., & Murray, C.J.L., (2003), Household catastrophic health expenditure: a multicountry analysis, Lancet, 362(9378), p111-117.

[https://doi.org/10.1016/s0140-6736(03)13861-5]

- Van Doorslaer, E., O’Donnell, O., Rannan-Eliya, R., Somanathan, A., Adhikari, S.R., Garg, C., et al. , (2006), Effect of health payments on poverty estimates in 11 countries in Asia: An analysis of household survey data, Lancet, 368(호), p1357-1364.

- Van Doorslaer, E., O’Donnell, O., Rannan-Eliya, R., Somanathan, A., Adhikari, S.R., Garg, C., et al. , (2007), Catastrophic payments for health care in Asia, Health Economics, 16(11), p1159-1184.

- Kim, H.R., Kang, Y.H., Yoon, K.J., & Kim, C.S., (2004), Socioeconomic health inequalities and counter policies in Korea, Seoul, Korea Institute of Health and Social Affairs.

- Korea National Health Insurance Corporation, (2007), National Health Insurance Statistical Yearbook, Seoul.

- Ranson, M.K., (2002), Reduction of catastrophic health care expenditures by a community-based health insurance scheme in Gujarat, India: Current experiences and challenges, Bulletin of the World Health Organization, 80(8), p613-621.

- Russell, S., (2004), The economic burden of illness for households in developing countries: a review of studies focusing on malaria, tuberculosis, and human immunodeficiency virus/acquired immunodeficiency syndrome, American Journal of Tropical Medicine and Hygiene, 71(Suppl. 2), p147-155.

- Short, K., & Garner, T., (2002), Experimental poverty measures: Accounting for medical expenditures, Monthly Labor Review, 125, p3-13.

- Korea Institute of Health and Social Affairs, (2006), The Third Korea National Health and Nutrition Examination Survey (KNHANES III), Seoul.

- OECD, (2007), Health Data, Paris.